At the onset of the trading day, the VN-Index displayed a robust opening, surging more than 5 points within the first 20 minutes. However, as the morning session progressed, the index experienced fluctuations, ultimately concluding with a slight decrease of nearly 0.5 points due to intensified selling pressure towards the session’s end. Notably, cash flow remained concentrated in a few select codes, scattered across various industries.

Closing at 1,172.55 points, the VN-Index reflected a marginal decline compared to the previous day. On the HoSE floor, 267 codes registered decreases, while 199 codes saw increases.

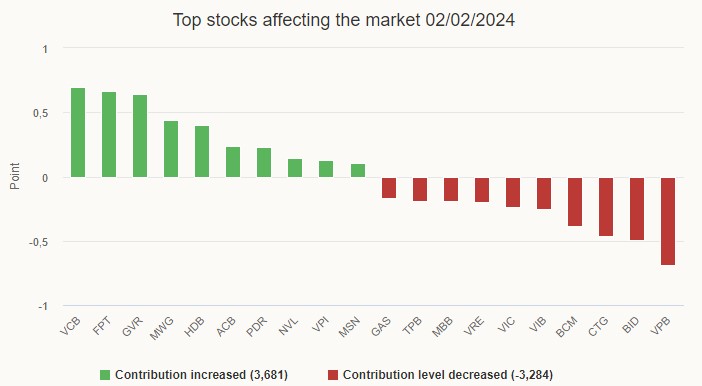

The technology, retail, and chemicals sectors maintained their lead in industry indices, propelled by key stocks like FPT, GVR, and MWG. These three stocks each recorded over a 2% increase, securing positions 2nd, 3rd, and 4th, respectively, among the top 10 contributors to the VN-Index.

Despite an overall dip in the real estate industry index, select stocks still exerted influence. Notably, NVL claimed the top spot in liquidity, representing over 1,130 billion VND and constituting nearly 6% of the total trading value on HoSE. Novaland’s stock code closed the session with a 1.8% increase. PDR, ranking second in liquidity with nearly 970 billion VND, posted a 4.4% gain over the reference, both contributing significantly to market growth.

Within the securities industry, the electricity board saw multiple green indicators. MBS closed the session with a 2.7% increase, while codes VIX and VCI both experienced over a 1% rise. SSI, despite a modest 0.4% increase in market price, boasted high liquidity, exceeding 820 billion VND.

Liquidity displayed an opposing trend to the index, with the total transaction value on HoSE exceeding 20,000 billion VND, marking an increase of over 4,700 billion VND.

Following three sessions of prioritizing goods consolidation, foreign investors returned to net selling, divesting more than 210 billion VND. Notably, their focus was on selling codes VNM, SHS, and PC1.

Siddhartha