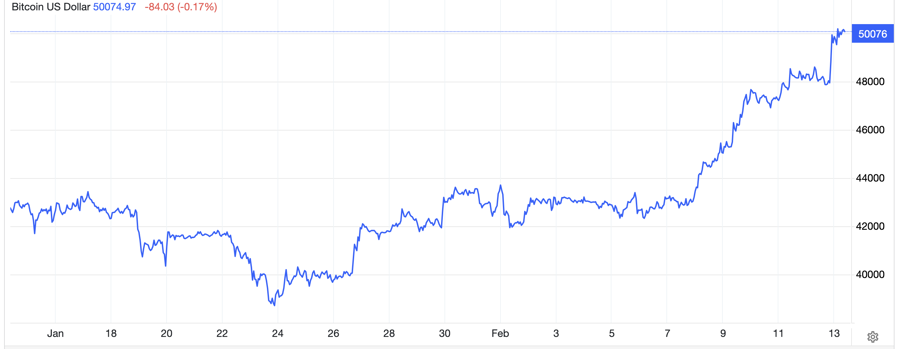

The price of Bitcoin breached the $50,000 mark, reaching its highest level in over two years, propelled by robust capital inflows into spot Bitcoin exchange-traded funds (ETFs). As of 9 a.m. Vietnam time on February 13, Bitcoin was valued at $50,134, marking a 3.3% increase within 24 hours and an almost 18% rise in the past week. Ether, the second-largest virtual currency, also experienced a sharp increase, reaching $2,679, up 6.4% from the previous day and over 16% in a week.

The market sentiment has turned optimistic after a substantial withdrawal of investors from the Grayscale Bitcoin ETF had previously fueled pessimism. The recent reduction in withdrawal activity and an uptick in inflows into spot Bitcoin ETFs have contributed to renewed positivity. In addition, Bitcoin’s price has benefitted from an increase in risk appetite, coinciding with the continued upward trajectory of the US stock market.

The recent milestone of $50,000 is seen as a significant achievement for Bitcoin, especially after spot Bitcoin ETFs were launched last month. This achievement contrasts with initial skepticism and a sell-off prompted by uncertainties surrounding the new investment products. Despite the milestone, investors remain cautious, considering the $48,600 threshold as a crucial resistance level for Bitcoin.

Technical analysts suggest that maintaining the $48,600 mark could propel Bitcoin to further surpass the $50,000 level and potentially set a new all-time high. The record high for Bitcoin was established on November 10, 2021, at nearly $69,000. In 2022 alone, Bitcoin prices have surged by over 16%.

The approval of the first spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) on January 10 marked a significant turning point for Bitcoin and the broader virtual currency industry. Analysts predict that spot Bitcoin ETFs could attract over $10 billion in capital this year, with some forecasting net capital flows of $50-100 billion into these funds in 2024.

Another contributing factor to Bitcoin’s price surge is the upcoming halving event scheduled for April. Occurring every four years, the halving event reduces the reward for Bitcoin miners, thereby limiting the supply of the virtual currency to a maximum of 21 million. Bitcoin’s price has historically increased following each of the three previous halving events, including the most recent one in 2020.